What is cryptocurrency? how does it function?

|

| What is cryptocurrency? how does it function? |

Definition and significance of digital currency

Any form of money that exists secretly or essentially and

makes use of encryption to facilitate transactions is known as cryptographic

money, sometimes known as digital money or crypto. Digital currencies use a

decentralized system to track transactions and create new units rather than a

central authority with granting or governing authority.

What is electronic money?

A computerized payment system using cryptographic currency

does not require banks to verify transactions. It is a distributed system that

enables anybody, anywhere, to send and receive payments. Cryptographic money

payments don't actually exist as real money that is carried around and sold;

rather, they exist as computerized parts of a web-based data set that shows

explicit exchanges. The transactions are preserved as a public record when you

transfer digital currency reserves. Digital currency is stored in sophisticated

wallets.

The moniker "cryptographic money" came about because it uses encryption to verify transactions. This suggests that advanced coding is connected to storing and transmitting digital currency information between wallets and to public records. Security is what encryption is meant to provide.

The main cryptocurrency at the time was Bitcoin, which was created in 2009 and is still the most widely used today. Interest in digital currencies is largely driven by the desire to trade for gain, with examiners occasionally pushing up prices.

How does cryptocurrency work?

Cryptographic kinds of currency operate on a distributed ledger of all transactions that are kept up to date by cash holders, known as the blockchain.

A process known as mining is used to create digital currency units. This interaction entails using a computer's processing power to solve complex mathematical puzzles that produce coins. Customers can also buy the monetary units from sellers, then store and use them through cryptographic wallets.

Even if you have digital cash, you have no real assets. What you possess is a key that enables you to transfer a record or a unit of measurement from one person to the next without the assistance of a trusted outsider.

Despite the fact that Bitcoin has existed since roughly 2009, there are still emerging financial applications for digital currencies and blockchain technology, and more are expected in the future. By using innovation, exchanges including bonds, stocks, and other financial resources may eventually be possible.

Models for digital currencies

There are many different types of cryptographic currency.

Probably the most common are:

Bitcoin:

Since its creation in 2009, Bitcoin has been the first and

most widely used cryptocurrency. The creation of the currency is credited to

Satoshi Nakamoto, a name used by an unidentified person or group whose precise

identity is still unknown.

Ethereum:

Ether (ETH),

often known as Ethereum, is a blockchain platform that was established in 2015.

After Bitcoin, it is the digital currency that is most well-known.

Litecoin:

While basically similar to bitcoin, this currency has

advanced even more quickly to support new developments, such as quicker

installments and cycles to enable more exchanges.

Swell:

A transferred record framework called Swell was created in

2012. A wave is a tool that can be used to track more than only digital currency

trades. Its sponsoring organization has collaborated with several banks and

financial institutions.

To distinguish them from Bitcoin digital currency, non-Bitcoin digital currencies are collectively referred to as "altcoins."

The most efficient way to get virtual currencies

How to buy digital currency safely. You may be wondering.

Typically, three stages are present. Which are:

What is cryptocurrency? how does it function?

Choosing a stage is stage 1

Choosing which stage to use is the first step. You can

generally choose between a traditional specialist and a dedicated digital

currency trade:

standard representatives. These online experts provide

methods for buying and selling digital currency as well as other types of

financial assets including equities, bonds, and ETFs. These platforms typically

have cheaper exchange rates but fewer crypto features.

Trading in digital currency. There are many digital currency

exchanges to research, and each one offers different cryptographic forms of

money, wallet capacity, and premium-bearing record options, and that's just the tip

of the iceberg. Resources are a common basis for trade costs.

When examining altered stages, take into account the

available cryptographic payment methods, the costs associated with using them,

the security features they offer, the options for depositing and withdrawing

funds, and any educational resources.

Stage 2: Paying for your recording

The next step is to subsidize your record once you have

chosen your foundation.

Although this varies by stage, fiat (i.e., legally

sanctioned) monetary standards like the US Dollar, the English Pound, or the

Euro are used.

Charge card purchases of cryptocurrencies are regarded as risky, and some exchanges do not support them. By the same token, some Visa organizations do not allow cryptocurrency exchanges. Due to the extreme instability of digital currencies, it is inappropriate to risk going into the red or even incurring significant charge card exchange fees in order to purchase specific resources.

A few steps will also recognize wire and ACH transfers. The accepted payment methods and processing times for purchases or withdrawals vary per stage. Similar to that, the length of time required for stores to clear varies by method of installment.

speculative vehicles: Costs should be taken into account.

Along with transaction fees, these also include potential store and withdrawal

exchange costs. Charges may vary depending on the stage and installment

approach, so this is something to look into right away.

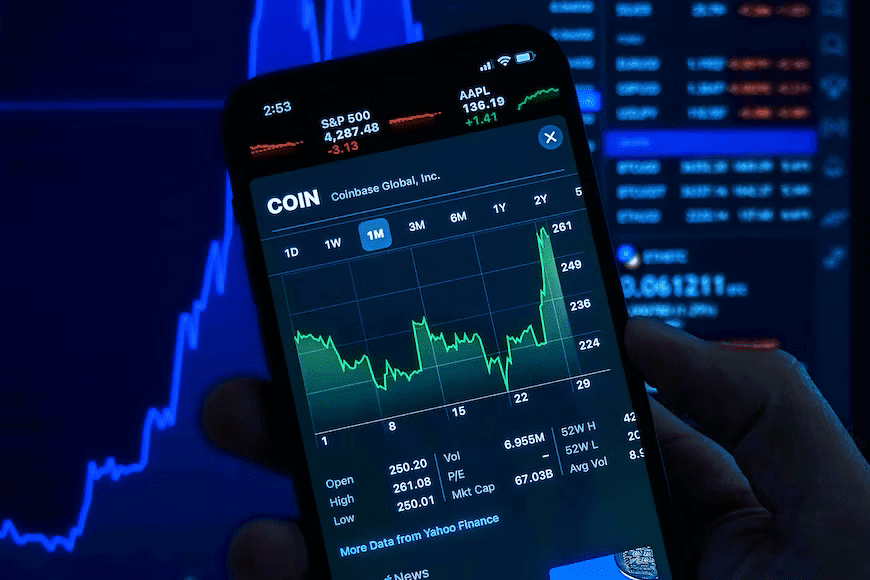

Third stage: making a request

You can submit a request using your merchant's website, or

alternatively, through the trade's mobile platform. If you want to buy

cryptographic forms of money, you can do so by selecting "purchase,"

choosing the request type, entering the amount you want to spend on digital

currencies, and then confirming the request. "Sell" orders interact

in a similar manner.

There are additional ways to invest in cryptocurrency. These

include payment processing services like PayPal, Money Application, and Venmo

that allow

Trusts in bitcoin: You can buy shares of trust in bitcoin

using a regular investing fund. These platforms allow ordinary investors access

to cryptocurrencies via the securities exchange.

Common Bitcoin assets You can go through Bitcoin shared

assets and ETFs.

Blockchain companies that have familiarity with the technology underlying cryptocurrencies and crypto exchanges are another indirect approach to investing in cryptocurrency. Blockchain stocks or ETFs. On the other hand, you can buy the stocks or exchange-traded funds (ETFs) of businesses that use blockchain technology.

The best option for you will depend on your venture

objectives and risk appetite.